“This post was sponsored by COUNTRY Financial® as part of an Influencer Activation for Influence Central and all opinions expressed in my post are my own.”

My kids are getting older. My oldest is a senior in High School this year so we are preparing him for living on his own soon. I feel like one of the most important things we can teach our kids is financial responsibility. It’s a challenge raising kids in this world that is run by money. Our kids are bombarded with advertisements of material goods. They want everything they see and unfortunately most of the time parents just buy whatever the child is asking for in exchange for peace. I get it. Sometimes it’s a bad day and the last thing you need is to drag a child throwing a fit through the store to get the rest of what’s on your grocery list. But what are we teaching our kids when they are handed everything? When they don’t understand why we are constantly asking them to turn off the lights in the house. When we buy them everything they ask for without really teaching them to save their own money to buy what they want. We are not teaching them anything. We are teaching them that they are entitled to everything they want. So today I’m going to share with you some of the things I’ve done with my kids to teach them to appreciate money and to learn how to save and spend their money wisely. Of course I have a long way to go when teaching them financial responsibility because I have a lot of learning myself. But I know that if we start teaching them these things when they are young, they will grow up with a healthy outlook on money and how they can use it to help themselves and others.

First, have your kids help you pay the bills. And when I say help you, I mean have them open the bills, and learn how to pay them online (with your money, not theirs). When my kids learn how much the electricity bill is every month, they are the ones walking around the house turning the lights off because they realize what it costs to keep those lights on. When they see how many gallons of water our house uses, they turn the water off when they are brushing their teeth. It’s a wake up call for them. They will be more prepared to leave the house and live as a responsible adult if they really know how much it costs to live on their own.

Second, give your kids a “job”. If your kids are not 16 yet that doesn’t mean that they can’t earn money. Chores are an awesome way of rewarding your kids for a job well done. Kids will learn that if they don’t “show up” to a job (not getting their chores done) that there are consequences. Those consequences could be that they don’t get an allowance that week, or they don’t get to play video games that week. We don’t pay our kids to do their chores because we want to teach our kids that doing chores is a part of being a family and owning a home. We clean because we care about our healthy and our cleanliness. But we will pay our kids for doing big jobs. Like deep cleaning the fridge, de-frosting the freezer, cleaning the car, vacuuming under the couch cushions, etc.

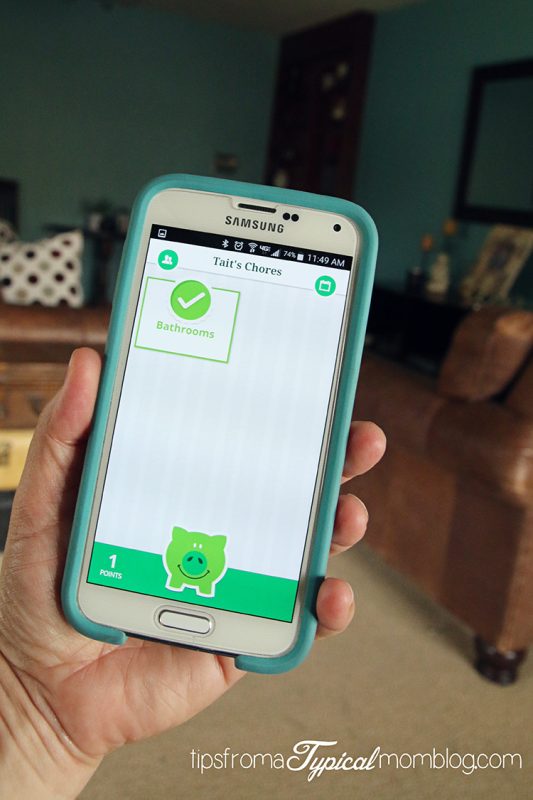

I’ve found a great app that has helped our family keep track of our chores. It’s called ChorePal from COUNTRY Financial®. COUNTRY Financial® developed the ChorePal app as a tool for kids and parents to keep track of household chores and rewards. This app is a tool for parents to introduce the kids to the value of hard work along with teaching the kids how to save and invest their money. It’s a simple and fun app to use and your family will love using it!

We just started using it and we love it. I love the fact that I can see when my kids are done with their chores and I can approve them before they get their reward. You can reward them with money or points depending on what your family chooses to use for their reward system. I can keep track of each child separately and check their progress each day.

COUNTRY Financial® is a full-service insurance and financial services company. They offer auto, home, business and life insurance along with retirement planning services, investment management and annuities. They are in your communities and they have a personal approach to planning for your financial future. They care about you and your families and have learned that we are all worried about our teaching our children about finances. That’s where the development of the ChorePal app started.

Third, teach your kids how to save for their future. Have a conversation often about your child’s plans for the future. Help them make goals like attending a certain college, saving for a car, or a wedding. Whatever they are interested in, I guarantee that you can think of a reason to save. We teach our kids to save at least 10% if their earnings if not more. And that savings NEVER get’s touched. It stays there. It’s there for the future, not the newest game console.

Fourth, teach them to save for the things they want. This is a different savings plan than the “future savings plan”. This money will accumulate to help the child buy the things they want. Like the new trendy clothes, a new video game, the coolest new toy. Teaching your kids to save for the things they want will teach them to not use credit in the future. Waiting to buy that impulse item will also help them prioritize their spending. Usually the longer they think about the purchase, the better. They may even realize how hard they worked for that money and not even buy that coveted thing anyway! That’s when I do the victory dance!

Fifth, teach them to give. My kids give 10% of all of their profit to our church as tithing. You can help your child choose a charity that they would love to support. By doing this we are teaching our kids to realize how blessed they are and turn their thoughts to others. Their empathy will grow and so will their gratitude for what they have been given.

Sixth, communicate with your kids often about finances. If you aren’t explaining to your kids why we save or give to charities none of these ideas will matter to them. Talk about money with your kids. Explain why you spend less than you earn and why you’re saving for retirement. Speak to them about why we can’t just go to the store all the time and buy what we want, or why we can’t take that big vacation this year. Speak to them maturely, they really understand a lot.

Teaching financial lessons is one of our responsibilities as parents. We want our kids to thrive when they leave our little nest, we want kids who can fly on their own. So start today buy downloading the ChorePal app from COUNTRY Financial® and get going!

What are some of your ideas for teaching your kids financial responsibility?

I think it is great to teach children about financial responsibility. You don’t want them to go out on their own and not be prepared. Great tips, thanks for sharing!

thanks for nice sharing